Online Finance Degree Program Highlights

Calculate a better future for yourself with a finance degree online.

Good financial sense can take you far in life. With so many unique financial challenges individuals, companies and organizations need to deal with, the world needs people to help make sense of it all. It’s no wonder financial professionals are in very high demand—and will be in demand for years to come. Our online finance degree is designed and taught by industry professionals who know exactly what it takes to succeed in the workforce.

- Not only does our bachelor’s degree in finance help you understand financial theory and improve your math and analytical skills, but it will also teach you how to apply those skills in many different ways, including to banking, corporate finance and financial planning.

- After gaining a well-rounded education through Baker, you’ll have a multitude of finance career opportunities open to you in fields like investment banking, corporate finance, financial markets and services or insurance. And after completing the bachelor of finance degree, the Baker MBA in Finance will continue to support your career in finance.

- The bachelor’s degree in finance at Baker College is accredited by the International Accreditation Council for Business Education (IACBE).

Learn Your Way

Finance classes are taught on the Cadillac, Muskegon, Owosso and Royal Oak campuses, as well as through Baker Online.

Learn MoreWhy Earn a Degree in Finance?

Financial analysts are the backbone of corporations, pension funds, insurance companies and other organizations and individuals who make investment decisions. Financial analysts provide information and critical guidance by applying their analytical and decision-making skills. From assessing stock and bond performance, studying trends and developing portfolio strategies and recommendations to meet financial goals financial analysts are important members of any corporate team.

Online Finance Degree Curriculum

The Baker College bachelor finance degree is a 4-year, IACBE-accredited program consisting of 120 credit hours (27 hours of finance major courses and 30 hours of general education courses). Our curriculum includes 63 hours of business requirements, including business analytics, personal financial planning and a capstone course (finance seminar).

Sample Courses

Business Analytics

Personal Financial Planning

Finance Seminar

Additional Finance Major Requirements

Beginning July 1, 2003, students pursuing a CPA licensure in the state of Michigan will be required to have obtained 225 quarter hours of credit prior to applying for a CPA license. While the degree in finance satisfies the requirements to sit for the Uniform Certified Public Accountant Examination, additional credit is needed for licensure. Individuals are therefore advised to contact the Michigan State Board of Accountancy Licensing Bureau for further information.

Students wishing to become eligible to sit for the examination in other states are recommended to check with the National Association of State Boards of Accountancy (www.nasba.org), which serves as a forum for the 54 U.S. boards of accountancy, for the state in which they intend to practice.

Finance Degree Online Outcomes & Performance

Our quality-focused, market-driven and rigorous bachelor's degree in finance online curricula will establish and enhance core business knowledge and the ability to anticipate and react to societal changes, as well as provide students with technological proficiency, the ability to make ethical decisions and the communication skills that embody the professional acumen graduates need to make positive contributions to their chosen fields.

Frequently Asked Questions

In a finance BBA program, you’ll develop a comprehensive skill set that prepares you for success in various finance roles. You’ll gain technical expertise in financial modeling, statement analysis, investment management, risk assessment, and valuation techniques—essential tools for careers in banking, corporate finance, and wealth management.

Equally important, a finance degree emphasizes essential soft skills—like communication, critical thinking, ethical decision-making, and collaboration—which are increasingly valued in today’s finance landscape. Through real-world projects, simulations, and case studies, you’ll learn to apply theory to practical scenarios, ensuring you graduate not just knowledgeable, but also career-ready.The Baker BBA in finance is a 120-credit-hour program, which is typically completed in four years of full-time study. The finance curriculum includes a mix of general education, core business courses, and finance-specific classes, providing a structured pathway to graduation and workforce readiness.

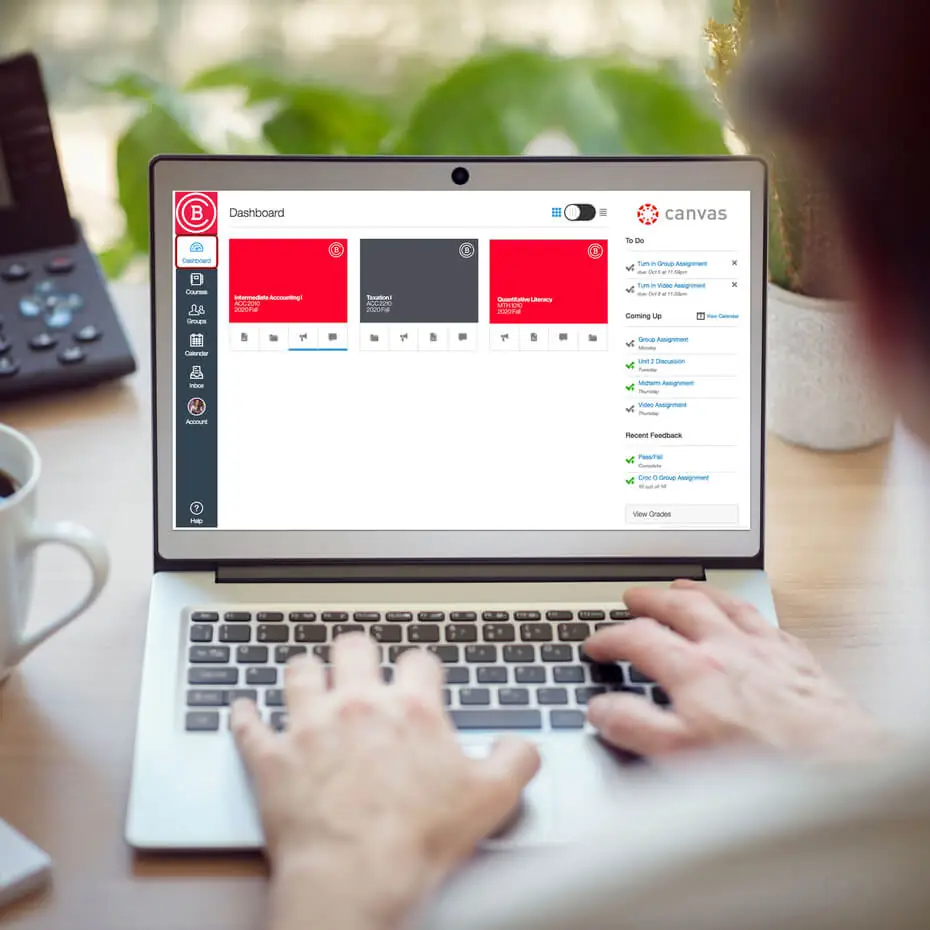

Yes! Our finance degree is fully online through Baker Online, allowing students to complete their coursework remotely. Finance courses and general education courses are available in flexible 8-week terms designed to fit busy schedules, with full instructor support, interactive discussions, and career guidance. Online learners enjoy the same accredited finance curriculum, faculty, and career-focused experience as their on-campus peers.

With a bachelor’s degree in finance, graduates are well-equipped to step into roles like financial analyst, investment advisor, risk manager, corporate treasurer, or financial planner, and entry-level finance careers in banking and insurance. Pairing this degree with an MBA enhances the path into senior-level careers in finance such as portfolio manager, investment banker, or CFO. Ready to explore more? Learn more about available careers in finance.

Here’s what you can expect to study in the finance bachelor degree:

- General education (30 credits) – foundational courses in communication, mathematics, and natural and social sciences

- Business core (45 credits) – essential topics like accounting, marketing, management, and economics

- Finance specialization (45 credits) – courses such as corporate finance, investments, financial markets & institutions, risk management, international finance, and a senior capstone in finance to prepare you for real-world scenarios

Yes! A bachelor in finance is structured to lay a strong academic foundation for advanced study. We offer a streamlined 3+1 BBA/MBA pathway, allowing you to begin earning graduate credit—up to 15 MBA hours during your junior and senior years—so you can obtain both finance degrees in just five years.

Coursework in corporate finance, investments, risk management, and international finance ensures you're well-prepared for graduate-level business programs. With this integrated pathway, you not only save time and money but also position yourself for leadership roles faster.In our finance bachelor degree, you'll build a well-rounded set of technical and professional skills essential for success in finance and business. You’ll strengthen your analytical and critical thinking abilities, learn to make data-driven decisions, and develop expertise in financial modeling and risk assessment. You’ll also enhance soft skills like leadership, ethical decision-making, teamwork, and clear business communication—skills highly valued by employers across industries. This combination prepares you to confidently step into a variety of finance careers or pursue graduate studies.

Absolutely. A BBA in finance from Baker College yields both solid financial knowledge and versatile career skills that prepare you for high-demand roles in areas like investing, corporate finance, and wealth management. Beyond technical knowledge, the finance BBA sharpens critical thinking, ethical decision-making, and leadership—qualities employers consistently seek. Learn more benefits of earning a bachelor's degree in finance!

A finance degree can be challenging, but it’s very achievable with dedication and the right support. You’ll tackle subjects like financial analysis, investments, and corporate finance, which require strong analytical and problem-solving skills. At Baker, finance courses are designed to be practical and approachable, with plenty of resources such as tutoring, faculty guidance, and career services to help you succeed. With commitment and curiosity, most students find the BBA in finance both manageable and rewarding.

Bachelor's Degree in Finance Accreditation

External peer review is the primary means of assuring and improving the quality of higher education institutions and programs in the United States. This recognition is accomplished through program accreditation, approval or certification.

The College of Business at Baker College has received specialized accreditation for its business programs through the International Accreditation Council for Business Education (IACBE) located at 11960 Quivira Road in Overland Park, Kansas, USA. For a list of accredited programs please view our IACBE member status page.

On Campus Available

View campus locationsAvailable on Baker Online

Courses for this degree program are available through Baker Online.

100% online, this format offers flexible scheduling with 8-week semesters

Baker OnlineUnavailable on Online Live

Core courses for this degree program are not offered through Online Live.

For those interested, a selection of general education and prerequisite courses are available through Online Live each semester.

Online Live